Facing unexpected roofing replacement costs that could derail your construction budget? Understanding high seam metal roofing price drivers helps commercial property managers and facility owners make informed decisions without compromising quality or exceeding financial constraints. High seam metal roofing systems typically range from ten to thirty-five dollars per square foot installed, with material choices, panel specifications, and project complexity fundamentally determining your final investment.

Understanding Material Selection Impact on High Seam Metal Roofing Costs

The foundation of high seam metal roofing pricing begins with material selection, where performance requirements meet budget realities. Commercial and industrial building owners face critical decisions that affect both upfront investment and long-term operational expenses. Material type represents the single most influential cost variable in any high seam metal roofing project, determining not only the initial purchase price but also installation complexity, maintenance requirements, and system longevity. Premium aluminum alloys including 3003, 3004, and 5052 grades deliver exceptional corrosion resistance particularly valuable in coastal environments or chemical processing facilities. These aluminum-magnesium-manganese compositions maintain structural integrity while remaining lightweight, reducing load requirements on existing building frameworks. Galvanized steel options including G90 coatings and galvalume alternatives with AZ50 or AZ55 specifications offer robust durability at more accessible price points, making them ideal for warehouses, manufacturing plants, and logistics centers where budget efficiency matters without sacrificing performance standards. Stainless steel grades 304 and 316 command premium pricing but deliver unmatched longevity in harsh industrial environments with extreme temperature fluctuations or chemical exposure. Copper and titanium-zinc materials represent the upper tier of high seam metal roofing investments, frequently specified for architectural projects, public buildings, and heritage restoration work where aesthetic distinction and century-long service life justify elevated initial expenditure. Understanding these material distinctions helps project stakeholders align roofing system specifications with functional requirements and financial parameters.

Thickness and Gauge Specifications

Metal thickness directly correlates with panel strength, impact resistance, and price structure within high seam metal roofing systems. Panel thickness ranging from 0.5mm to 1.2mm accommodates diverse structural requirements and budget considerations across commercial and industrial applications. Lower gauge numbers indicate thicker, more robust panels that withstand heavy snow loads, resist hail damage, and minimize oil-canning effects on large uninterrupted roof surfaces. Thicker gauge panels reduce the frequency of metal roof seam repair interventions over the system's operational lifetime, delivering cost savings through decreased maintenance cycles. Industrial facilities in regions experiencing severe weather events benefit from 0.9mm to 1.2mm panel thickness despite higher material costs because replacement expenses and operational disruptions from storm damage far exceed the incremental investment in robust specifications. Commercial buildings with moderate environmental exposure can optimize value through 0.6mm to 0.8mm thickness selections that balance performance with budget efficiency. The relationship between panel width specifications and gauge requirements creates additional cost considerations. Wider panels spanning 400mm to 600mm require appropriate thickness to prevent structural deflection under load conditions. Understanding these interdependencies prevents specification errors that compromise system performance or necessitate costly corrective measures during installation phases.

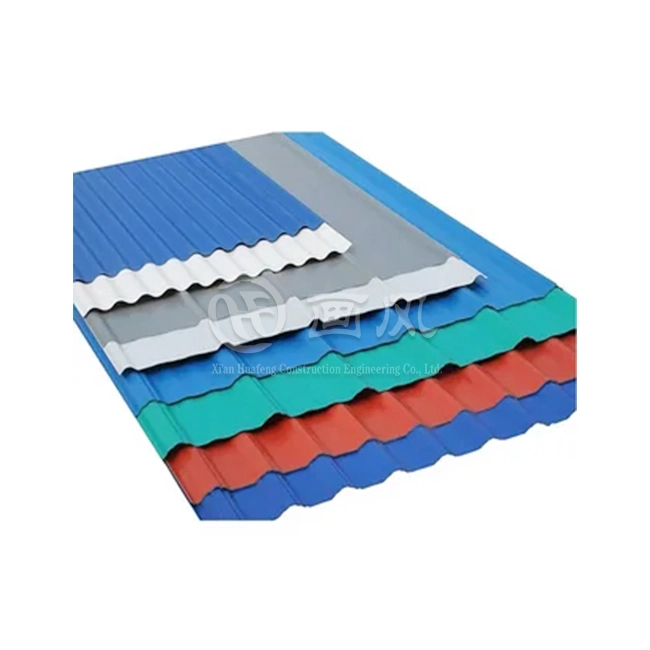

Surface Treatment and Coating Systems

High seam metal roofing performance and longevity depend substantially on protective coating systems that shield base materials from ultraviolet degradation, chemical exposure, and moisture infiltration. PVDF (polyvinylidene fluoride) coating technology represents the premium standard in commercial roofing applications, delivering superior color retention, chalk resistance, and weatherability compared to conventional polyester alternatives. These fluoropolymer finishes maintain aesthetic appearance and protective properties for three decades or longer, reducing lifecycle costs despite higher initial material pricing. PE (polyester) coatings offer more economical entry points for budget-conscious projects while still providing adequate protection in moderate environmental conditions. The coating selection decision impacts not only material acquisition costs but also warranty coverage, with manufacturers typically extending 30-year fade warranties on PVDF systems compared to shorter coverage periods for standard polyester finishes. This warranty distinction carries significant financial implications when evaluating total ownership costs across expected building service lives. Color selection within coating systems introduces additional pricing variables, particularly for custom RAL specifications or specialized reflective pigments that enhance energy efficiency. Lighter color selections in PVDF formulations provide superior solar reflectance, reducing cooling loads in commercial facilities and potentially qualifying for energy efficiency incentives that offset premium coating investments. Dark colors and custom matches generally command price premiums due to specialized manufacturing requirements and lower production volumes.

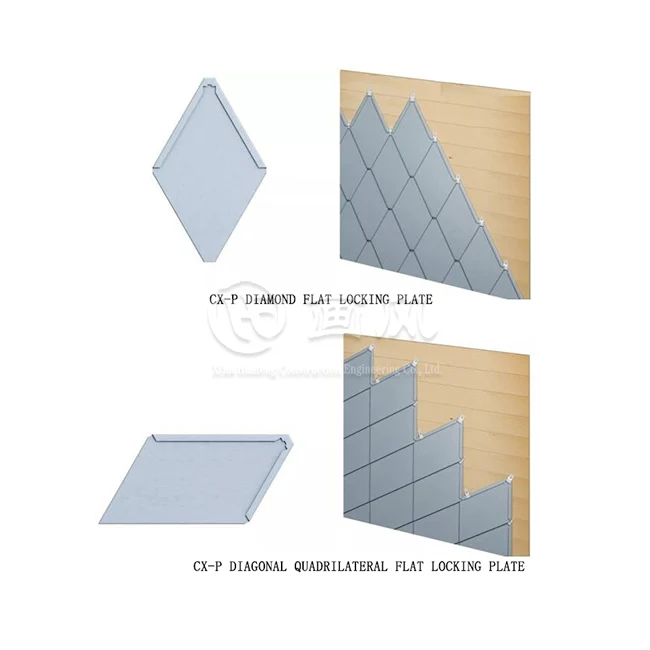

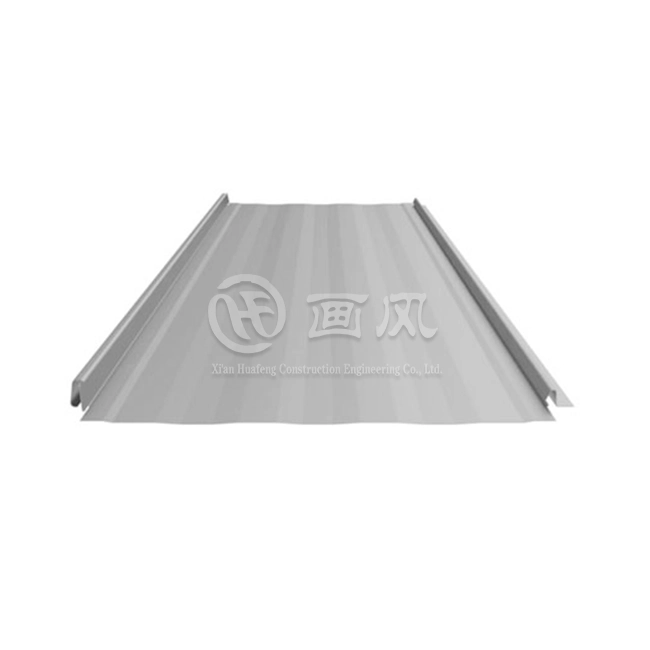

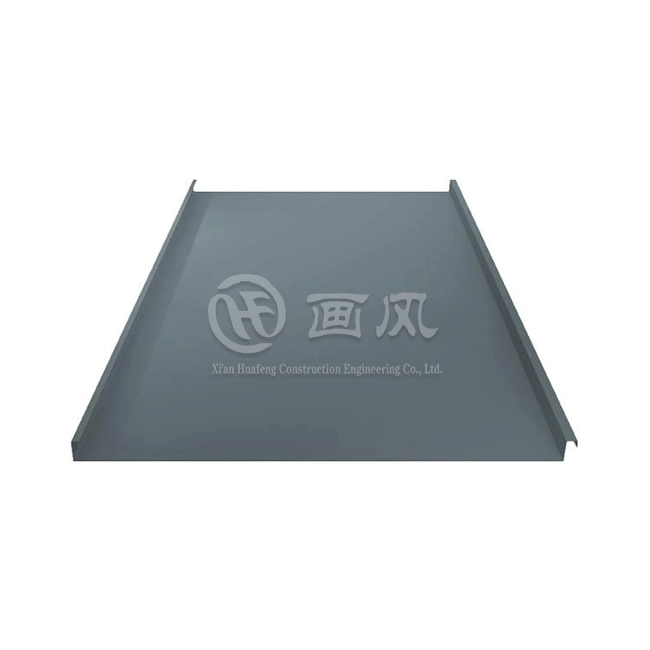

Panel Configuration and Specification Variables

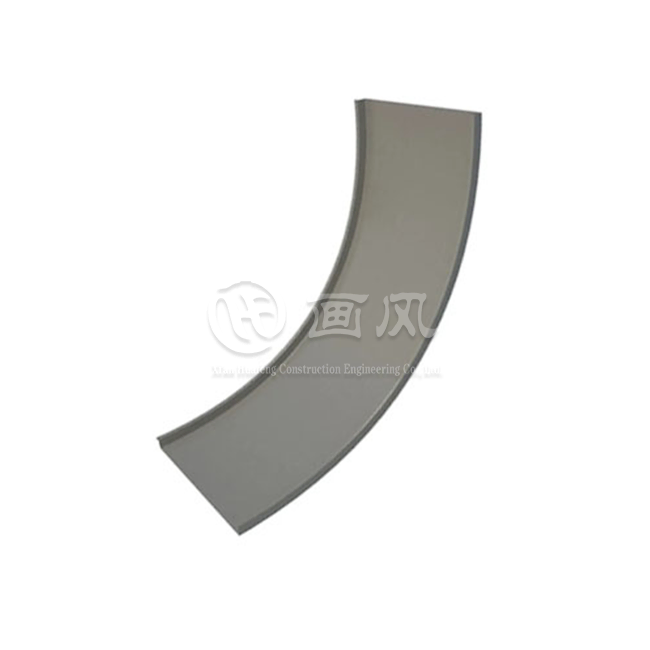

High seam metal roofing systems encompass diverse panel profiles and seam height specifications that influence both aesthetic outcomes and cost structures. The distinctive raised seam characteristic of these systems serves functional and visual purposes, with seam heights typically ranging from 65mm in standard commercial applications to specialized profiles exceeding 100mm for architectural statement projects or enhanced water-shedding performance in high-precipitation regions. Panel width specifications between 300mm and 600mm affect material efficiency, installation labor requirements, and visual rhythm across large roof expanses. Narrower panels create more frequent seam lines, potentially increasing both material waste during fabrication and field labor during installation phases. Wider panels reduce seam frequency but require enhanced thickness specifications to maintain structural performance without deflection issues. The relationship between these dimensional specifications and project costs extends beyond simple material calculations. Complex roof geometries with numerous penetrations, direction changes, or architectural features demand smaller panel widths for fabrication flexibility, increasing both material and labor costs compared to straightforward rectangular roof areas that accommodate efficient wide-panel installation. Project specifications balancing these variables achieve optimal value without compromising performance or aesthetic objectives.

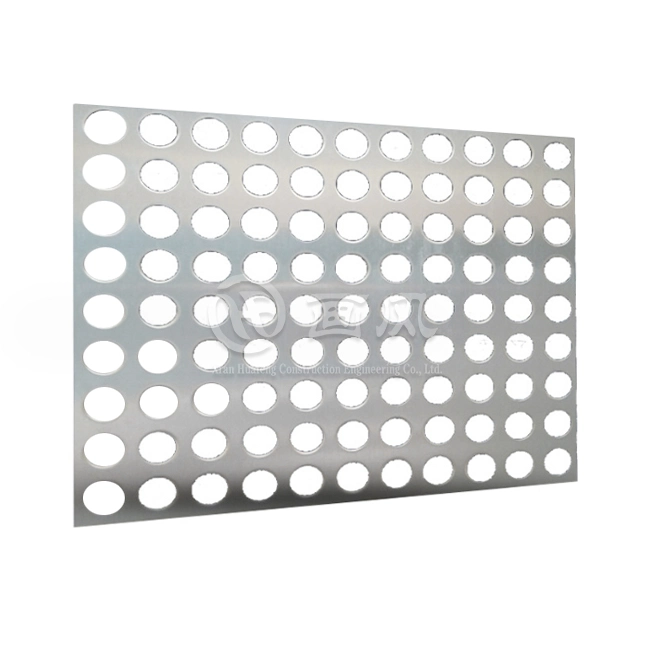

Manufacturing and Customization Requirements

High seam metal roofing systems manufactured to precise project specifications involve sophisticated roll-forming equipment and technical expertise that influence pricing structures. Custom panel lengths eliminate horizontal seams across roof slopes, enhancing weather-tightness and visual continuity while requiring specialized production capabilities. Xi'an Huafeng Construction Engineering Co., Ltd. operates three dedicated factories with seven production lines and more than forty specialized machines capable of manufacturing custom panel configurations up to 1000 tons monthly capacity, ensuring consistent quality and delivery reliability for large-scale commercial projects. On-site roll-forming represents an alternative manufacturing approach that generates panels at the installation location, eliminating transportation damage risks and accommodating unlimited length requirements. This methodology suits complex or remote projects where freight costs and lead times would otherwise escalate budgets. The equipment investment and technical skill requirements for on-site forming typically result in higher installation costs compared to factory-prefabricated panels, though project-specific variables including site accessibility and panel length requirements determine optimal manufacturing approaches. Customization extends beyond dimensional specifications to encompass specialized perforation patterns, integrated solar mounting provisions, or proprietary fastening systems that enhance performance characteristics. These enhancements incrementally increase material costs while delivering functional advantages that justify investments through operational benefits or extended system longevity.

Installation Complexity and Labor Cost Drivers

Labor represents 60 to 70 percent of total high seam metal roofing project costs, making installation variables crucial to budget accuracy and project feasibility. Skilled installation crews command premium rates reflecting specialized training, safety certification, and technical expertise required for proper seam-locking techniques and weatherproofing details. Regional labor market conditions, seasonal demand fluctuations, and contractor availability significantly influence installation pricing across different geographic markets and project timing scenarios. Roof complexity fundamentally determines labor requirements and associated costs. Simple rectangular roofs with minimal penetrations, consistent slopes, and straightforward perimeter conditions allow efficient panel installation and seaming operations. Complex geometries featuring multiple roof levels, numerous HVAC penetrations, skylight integration, or intricate architectural details require additional cutting, fitting, and custom flashing fabrication that multiply labor hours beyond basic installation rates. Roof pitch and accessibility considerations create additional labor cost variables. Steep slopes exceeding standard safety thresholds necessitate enhanced fall protection systems, specialized equipment, and modified installation procedures that extend project timelines and increase labor expenses. Multi-story buildings or installations requiring crane access for material lifting introduce equipment rental costs and coordination complexities that escalate overall project budgets.

Existing Roof Removal and Substrate Preparation

High seam metal roofing installation frequently requires existing roof system removal, presenting significant cost implications that vary based on current conditions. Single-layer tear-offs generate moderate disposal expenses and labor requirements, while multiple-layer removals compound costs through increased weight, handling complexity, and landfill fees. Substrate inspection following tear-off operations may reveal concealed damage requiring deck board replacement, structural reinforcement, or moisture remediation that wasn't apparent during initial project scoping. Proper substrate preparation ensures high seam metal roofing system performance and longevity. Damaged decking compromises fastener holding capacity and creates deflection issues that telegraph through finished roofing panels. Comprehensive inspection and remediation processes protect against future metal roof seam repair requirements stemming from inadequate substrate conditions. These preparation activities represent essential investments in system integrity rather than optional cost areas subject to value engineering reductions. Underlayment selection and installation methodology contribute additional cost layers while providing critical moisture protection and thermal performance benefits. High-temperature ice and water shield products specified for metal roofing applications command premium pricing compared to standard felt alternatives but deliver superior adhesion, vapor management, and long-term reliability that justify incremental investments.

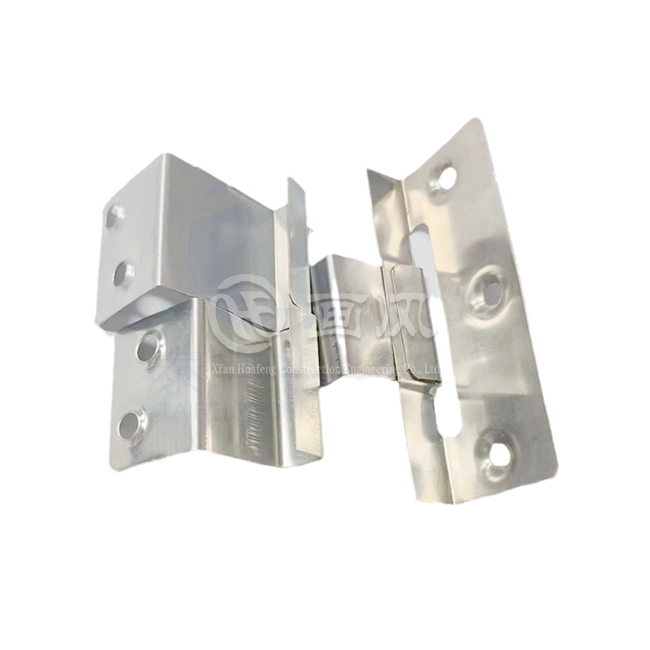

Trim, Flashing, and Accessory Components

High seam metal roofing systems require comprehensive trim and flashing packages that seal perimeter conditions, accommodate penetrations, and manage water diversion at critical junctures. These components typically represent 25 to 40 percent of material costs beyond primary panel expenses, with standing seam systems requiring more extensive trim packages compared to exposed fastener alternatives. Ridge capping, eave trim, rake edges, valley flashings, and penetration boots must coordinate with panel profiles and maintain weatherproofing integrity across the entire roof assembly. Custom flashing fabrication for unusual conditions, architectural features, or equipment integration adds incremental costs through specialized forming requirements and installation complexity. Z-bar profiles, starter strips, and panel-to-wall transitions demand precise measurements and skilled installation to prevent water infiltration vulnerabilities. Understanding trim requirements during estimating phases prevents budget shortfalls when actual material takeoffs reveal component quantities exceeding preliminary assumptions. Accessory integration including snow retention systems, walkway pads, or solar mounting hardware introduces additional cost considerations while enhancing functionality and protecting roof system integrity. These supplementary components require coordination with panel installation sequences and may necessitate structural calculations to verify adequate load capacity, particularly for solar array installations that impose significant additional weight and wind-loading scenarios.

Geographic and Regulatory Cost Influences

Regional variations in material availability, labor rates, and permitting requirements create substantial cost differences for identical high seam metal roofing specifications across different markets. Coastal regions typically experience elevated pricing due to corrosion-resistant material specifications and enhanced fastening requirements for hurricane wind resistance. Remote or rural locations may encounter freight surcharges and limited contractor availability that inflate project costs beyond metropolitan market benchmarks. Local building codes and permitting requirements impose varying levels of complexity and expense across jurisdictions. Some municipalities mandate structural engineering calculations, detailed shop drawings, or multiple inspection phases that extend project timelines and professional service costs. Understanding these regulatory frameworks during preliminary planning prevents unexpected expenses that compromise project feasibility or require scope reductions to maintain budget targets. Climate-specific design considerations influence both specification requirements and installation costs. High snow-load regions necessitate enhanced structural capacity through thicker panels, closer fastener spacing, or reinforced substrate framing. High-wind coastal zones require certified fastening systems with enhanced pull-out resistance and more frequent attachment patterns. These region-specific requirements directly affect material quantities, labor intensity, and overall project costs compared to moderate climate installations.

Seasonal Timing and Market Dynamics

Project scheduling decisions significantly impact high seam metal roofing costs through seasonal demand cycles and weather-related installation constraints. Peak construction seasons during spring and summer months see elevated contractor rates and longer lead times as installation crews maximize profitable weather windows. Strategic scheduling during shoulder seasons or winter months in moderate climates can yield substantial cost savings through reduced labor rates and improved contractor availability, though weather risks and shorter working days may offset scheduling advantages. Material pricing fluctuates based on global metal commodity markets, manufacturing capacity utilization, and supply chain dynamics. Steel and aluminum raw material costs respond to international trade policies, mining output variations, and infrastructure investment cycles that create pricing volatility beyond individual project control. Long-term material commitments or phased procurement strategies can mitigate some price risk for large portfolio projects spanning multiple installation phases. Current market conditions in 2025 reflect ongoing material price pressures and skilled labor shortages that elevate high seam metal roofing costs compared to historical averages. Project stakeholders must account for these macroeconomic influences when developing budgets and evaluating system alternatives, recognizing that cost-optimal decisions require balancing immediate pricing against long-term value propositions including durability, maintenance requirements, and energy performance benefits.

Long-Term Value and Total Cost of Ownership

High seam metal roofing systems command premium upfront investments compared to conventional alternatives, yet comprehensive lifecycle cost analysis frequently reveals superior economic value over typical building ownership periods. System longevity ranging from 40 to 70 years depending on material selection dramatically exceeds asphalt shingle replacements cycles of 15 to 25 years, eliminating multiple replacement expenses and associated business disruptions over equivalent timeframes. Maintenance requirements for high seam metal roofing remain minimal compared to alternative systems, primarily involving periodic inspections, gutter cleaning, and occasional metal roof seam repair interventions addressing isolated damage or wear conditions. The absence of organic materials prevents biological growth, granule loss, or UV breakdown that plague conventional roofing products. This maintenance efficiency translates to reduced operational expenses and deferred capital outlays that compound financial advantages over extended ownership periods. Energy performance benefits associated with reflective metal surfaces and ventilated assembly designs reduce cooling loads in commercial facilities, generating ongoing operational savings that offset higher initial installation costs. Many high seam metal roofing specifications qualify for energy efficiency incentives, green building certifications, or insurance premium reductions that provide quantifiable financial returns independent of avoided replacement expenses. Comprehensive economic analysis incorporating these diverse value streams demonstrates compelling investment cases for high seam metal roofing despite elevated first costs.

Return on Investment Considerations

Property value appreciation associated with premium roofing systems provides additional financial justification for high seam metal roofing investments. Commercial properties featuring long-life building envelope systems command higher sale prices and attract quality tenants seeking facilities with minimal deferred maintenance exposure. The aesthetic distinction of high seam metal roofing contributes to architectural appeal that enhances marketability for office buildings, retail facilities, and public institutions where visual identity matters to organizational mission and brand positioning. Risk mitigation represents another crucial but often overlooked value dimension. High seam metal roofing delivers superior performance during extreme weather events including hurricanes, hailstorms, and wildfire exposures that increasingly threaten commercial property portfolios. Avoided business interruption costs, inventory losses, and emergency remediation expenses from catastrophic roof failures provide insurance-like benefits that justify premium system investments even when base probability scenarios suggest low likelihood of extreme events during any particular ownership period. Environmental sustainability considerations increasingly influence commercial building investment decisions as organizations pursue carbon reduction commitments and environmental stewardship objectives. High seam metal roofing systems featuring recycled content, complete recyclability at end-of-life, and energy efficiency attributes align with corporate sustainability mandates while delivering practical performance benefits. These alignment factors create value through stakeholder satisfaction, regulatory compliance, and competitive differentiation beyond strict financial return calculations.

Conclusion

High seam metal roofing costs reflect complex interactions between material specifications, installation variables, and project-specific conditions that demand comprehensive evaluation beyond simple per-square-foot comparisons. Strategic material selection, specification optimization, and contractor qualification ensure maximum value realization across total ownership timeframes rather than minimizing initial procurement expenses.

Cooperate with Xi'an Huafeng Construction Engineering Co., Ltd.

Xi'an Huafeng Construction Engineering Co., Ltd., established in 2018, stands as a leading China high seam metal roofing manufacturer delivering comprehensive design-through-installation solutions for commercial and industrial applications worldwide. Our integrated operations encompass a 200,000-square-meter raw material production facility in Anhui plus dedicated processing plants in Hangzhou and Xi'an, featuring seven color coating production lines and more than forty specialized manufacturing machines ensuring consistent high seam metal roofing quality and 1000-ton monthly supply capacity. As a recognized Shaanxi Province high-tech enterprise holding first-level building curtain wall qualifications and third-level steel structure certifications, we manufacture premium standing seam systems with 65-400/430/500 specifications in PVDF/PE surface treatments, 0.5-1.2mm thickness ranges, and customized RAL colors meeting ASTM, DIN, JIS, BS, and GB/T international standards. Our China high seam metal roofing factory delivers 30-year warranty protection, 500-square-meter minimum orders, and 15-20 day delivery timelines supporting project schedules across diverse industry sectors.

Our one-stop service model integrates structural 3D modeling, drainage simulation, material procurement from certified suppliers including Baosteel, Alucosuper, and NedZink, precision roll-forming production, comprehensive quality inspection protocols, and expert installation guidance backed by more than 20 registered patents and ISO9001, ISO14001, SGS certifications. We've successfully completed high-profile projects including Xiongan Station, Xi'an International Convention Center, Inner Mongolia Tongliao Art Museum, and numerous industrial facilities demonstrating our high quality high seam metal roofing capabilities.

Partner with China's premier high seam metal roofing supplier offering competitive wholesale pricing, customized engineering solutions, and turnkey procurement from raw materials through installation accessories. Our technical teams provide design optimization, raw material quality testing, multiple packaging options, and diverse transportation methods ensuring your project success. As a trusted China high seam metal roofing wholesale provider, we deliver value-added solutions for global customers seeking high seam metal roofing for sale with proven performance and competitive high seam metal roofing price structures. Contact huafeng@hfmetalroof.com today to discuss your project requirements and discover how our engineering expertise, manufacturing capacity, and quality commitment deliver superior outcomes for your commercial roofing investment.

References

1. Metal Roofing Alliance. "Standing Seam Metal Roof Installation Standards and Best Practices." Technical Bulletin Series, 2024.

2. National Roofing Contractors Association. "Metal Roofing Systems: Design and Installation Guidelines." NRCA Roofing Manual, 2023.

3. American Society for Testing and Materials. "Standard Specification for Steel Sheet, Metallic-Coated for Roofing and Siding." ASTM A792/A792M, 2023.

4. Building Research Establishment. "Metal Roof and Wall Systems: Performance and Cost Analysis." BRE Report BR 501, 2024.

5. International Code Council. "International Building Code Requirements for Metal Roof Systems." IBC Chapter 15: Roof Assemblies and Rooftop Structures, 2024 Edition.